Founded in 2008, Laurium Capital has grown from R100 million to over R83 billion in assets under management, navigating global crises, volatile markets, and South Africa’s unique challenges. It was hardly the textbook time to launch a new asset manager. But 17 years later - with a track record that spans multiple market cycles, a diverse suite of funds, and clients across South Africa, the rest of Africa, and the globe - we’re proud of the journey we’ve taken.

To our clients - thank you for the trust you’ve placed in us. Your support has been central to this journey, and we remain deeply committed to earning it every day.

Laurium launches the Laurium Long/Short Prescient RI Hedge Fund and the USD Chobe Long/Short Hedge Fund – marking the beginning of its investment journey.

The Laurium Market Neutral Prescient RI Hedge Fund is launched, expanding the hedge fund range.

Laurium enters the long-only space with the Laurium Flexible Prescient Fund and launches the Laurium Aggressive Long/Short Prescient QI Hedge Fund.

Laurium introduces the Laurium Limpopo Africa Fund and the Laurium Equity Prescient Fund, further diversifying its offering.

The Laurium Balanced Prescient Fund is launched, offering investors a diversified multi-asset solution.

Laurium opens its Cape Town office, bringing its investment expertise closer to clients in the Western Cape.

Laurium becomes a signatory to the UN Principles for Responsible Investment (UNPRI), formalising its ESG commitment.

Three new funds are launched: Laurium Income Prescient Fund, Laurium Africa USD Bond Prescient Feeder Fund (ZAR), and Laurium Stable Prescient Fund.

Laurium is selected to run the Amplify SCI Balanced Fund and PPS Stable Growth Fund, and acquires Tantalum to strengthen its capabilities.

The Nedgroup Value Fund merges into the Nedgroup/Laurium SA Equity Fund, and the Laurium Global Active Equity USD Fund is launched.

Laurium becomes a level 1 B-BBEE contributor and launches the Laurium Enhanced Growth Hedge Fund (USD UCITS).

The Laurium Global Active Equity Fund (USD) is redomiciled to Ireland, while two new South African funds are launched.

Laurium’s Cape Town team moves to The Osborne, Claremont. New fund launches include the Laurium Enhanced Growth Prescient RI Hedge Feeder Fund and Laurium Global Active Equity Prescient Feeder Fund. Laurium is appointed to manage the Curate Momentum Equity Fund.

From two hedge funds to over R70 billion in assets under management, Laurium Capital celebrates 17 years of passion, purpose, and performance.

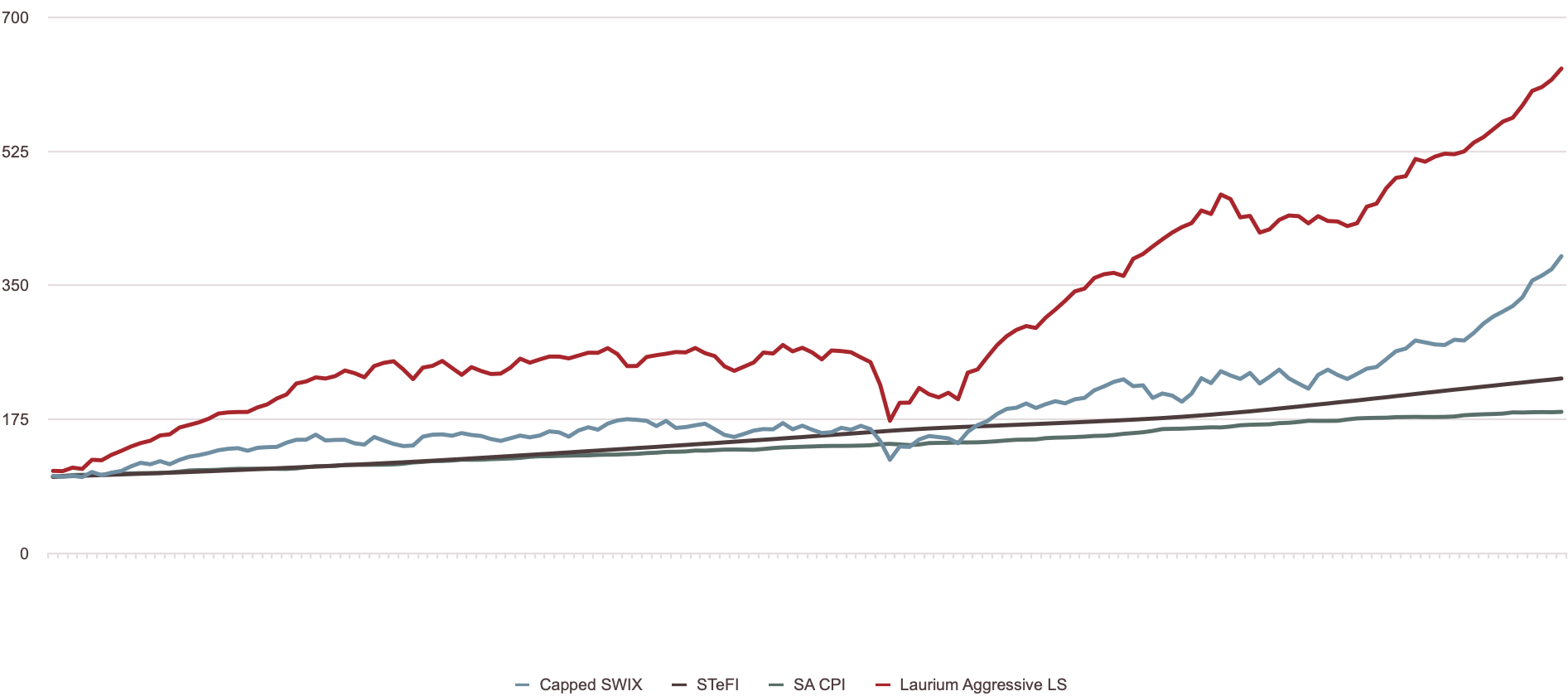

Laurium Aggressive Long Short Hedge Fund: 1 Jan 2013 – 31 Dec 2025

Source: Laurium Capital

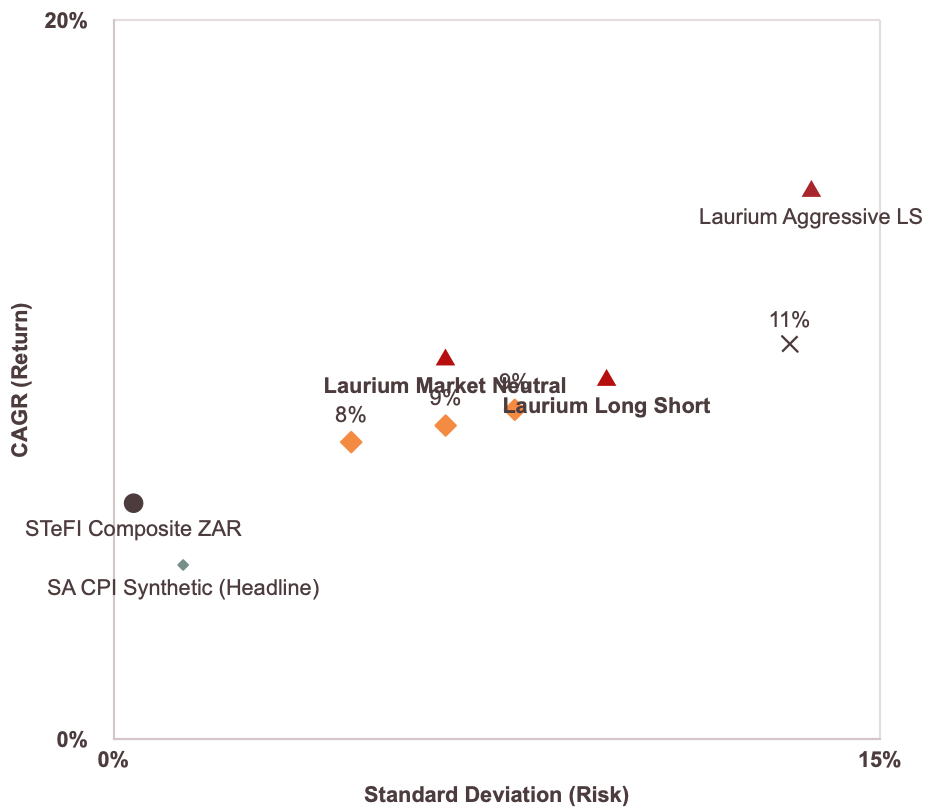

Since inception of Laurium Aggressive Long Short Fund: 1 Jan 2013 – 31 Dec 2025 (net of fees)

Source: Laurium Capital, Morningstar

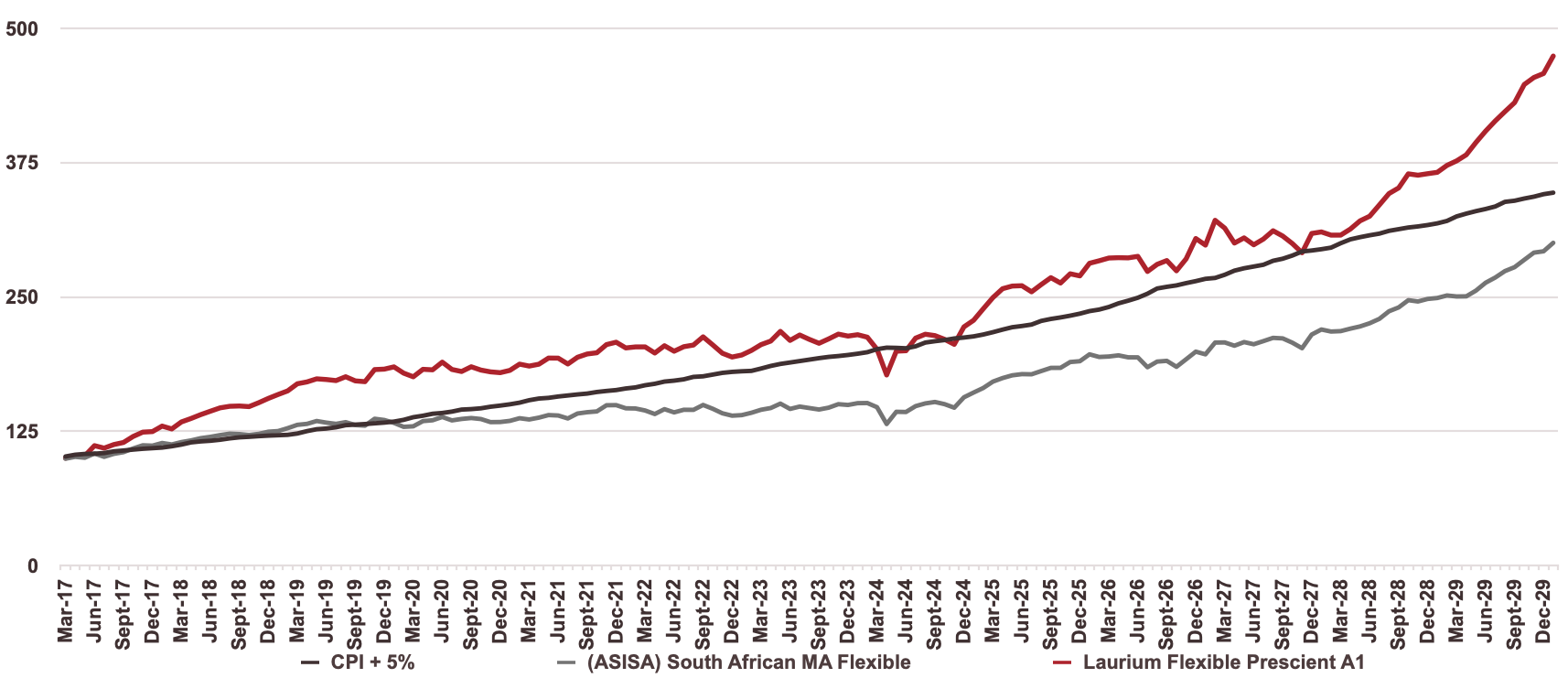

Flexible (net of fees) vs. CPI+5% vs. Peer Group: 1 Feb 2013 – 31 Dec 2025

Source: Laurium Capital

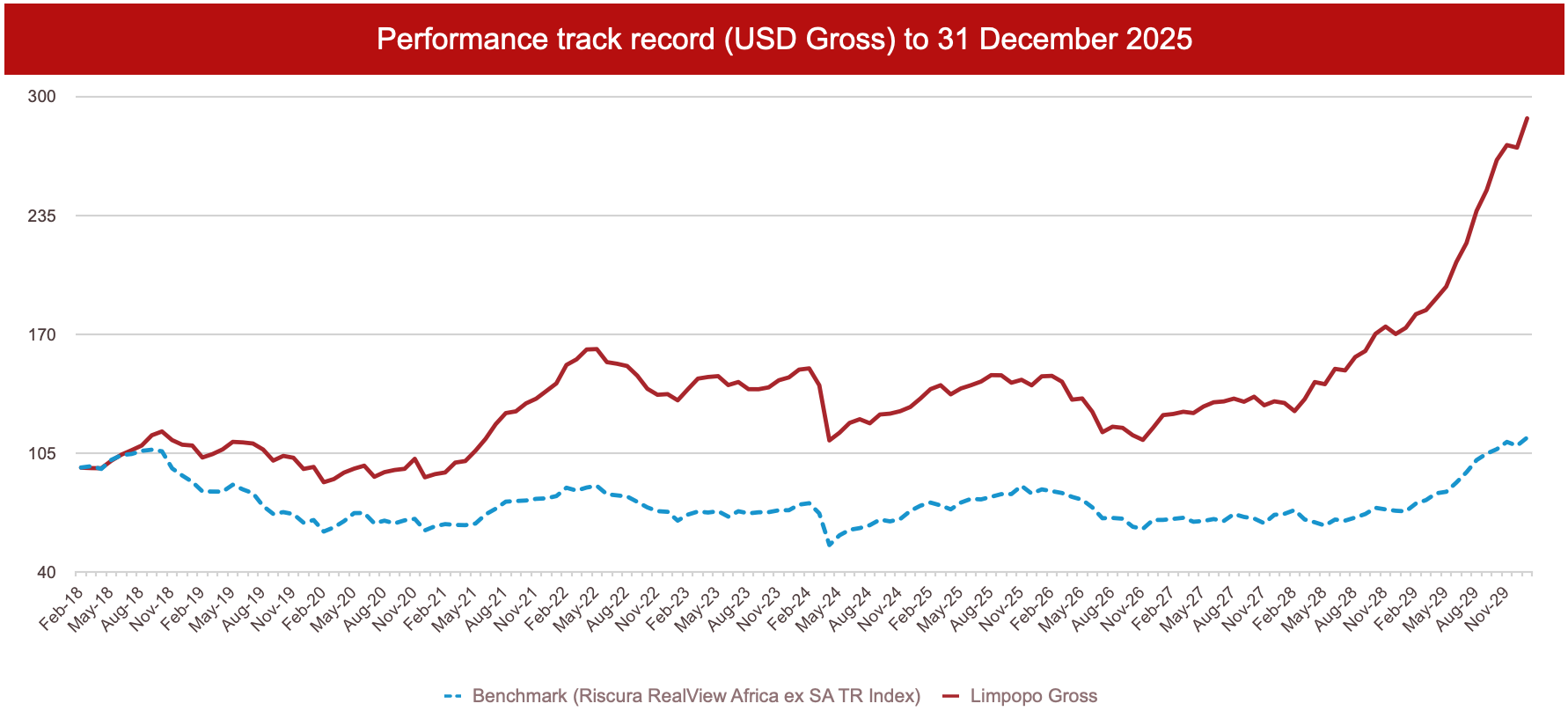

11 year track record of significant index out performance

Source: Laurium Capital

Founded in 2008, Laurium Capital has grown from R100 million to over R83 billion in assets under management, navigating global crises, volatile markets, and South Africa’s unique challenges. It was hardly the textbook time to launch a new asset manager. But 17 years later we have a track record that spans multiple market cycles and significant alpha against benchmarks, in almost every fund. Our clients are across South Africa, the rest of Africa, and the globe. We are proud of the journey we’ve taken and thank our clients for sharing it with us.

Anniversaries are a good time to pause, reflect, and share. Here are 17 lessons we’ve learned over 17 years of active investing.

Distractions dilute performance. We do one thing - manage investments - with no side ventures, ensuring our team’s energy stays on delivering alpha.

With over 300 years of collective expertise, our 42-person team combines local knowledge with global experience. Talent, temperament and team culture consistently trump any single factor or formula.

Our passion for clients’ futures, backed by a culture of excellence, has resulted in generating superior returns for our clients over time. Purpose keeps us focused for the next 17 years.

Long run, markets reward companies that generate a growing free cash flow stream. In the short term the market is a voting machine driven by investor’s emotions. This provides opportunities to those with a rigorous, tried and tested process - rooted in fundamental analysis and risk management.

Risk management is a foundational pillar of successful investing. It’s not just about avoiding losses — it’s about understanding, measuring, and strategically navigating uncertainty to preserve capital and achieve long-term objectives

Achieving Level 1 B-BBEE status in 2022 reflects our commitment to diversity. Over 50% Black and 40% women staff bring fresh perspectives to investing.

As a boutique manager, we’re nimble enough to seize opportunities - like mid-tier South African stocks - that larger firms overlook.

Africa is a continent of opportunity. Our on-the-ground research has consistently uncovered undervalued assets.

We target companies whose share prices deviate from their through-the-cycle cash flows, and are happy to wait for catalysts to unlock value.

Our team invests alongside clients, with more than 90 pc of their investable assets in our funds. This ensures we share the same risks and rewards as clients.

From hedge funds to long-only equity and fixed income, our diverse offerings - like our Global Equity Fund - build resilience across market cycles.

Markets will humble you. The moment you think you’ve figured it out is usually the moment you haven't. Intellectual humility and continuous learning are non-negotiable.

Returns matter, but consistency matters more. Time in the market trumps timing the market. Protecting capital in down markets is as important as participating in upswings. Compound returns reward patience.

Strong ties with South African and African companies give us an edge in understanding their strategies, enhancing our stock-picking

Long term track records separate skill from luck across multiple market cycles.

The top global education endowments have at least 20-30% allocation to hedge funds. Hedge funds have the potential to play a greater role in diversified portfolios — particularly as market volatility and uncertainty become more persistent features of the investment landscape. Follow the Smart Money!

Our Johannesburg, Cape Town, and London offices combine global insights with African expertise, as shown in our Global Active USD Equity Fund launch in 2021. As South African investors, we cannot afford to be inward-looking. Global diversification - both in opportunity and perspective - has been vital for building resilient portfolios.

Laurium Capital is an employee-owned boutique asset manager founded in 2008, managing over R83 billion across hedge funds, long-only equity, and fixed income strategies. With offices in Johannesburg, Cape Town, and London, we combine on-the-ground research with disciplined portfolio construction to deliver superior risk-adjusted returns. Contact us at ir@lauriumcapital.com to learn more.

*Laurium Capital (Pty) Ltd is an authorised financial services provider. Reg No. 2007/026029/07. FSCA No. 34142. Past performance is not a guide to future results.*